How to make money from home

Or rather, from your home. That’s right, many of you might have a spare bedroom in your place that is doing little more than holding boxes or being used as storage. And you might occasionally use it when guests come into town. But what if you could turn that space into a revenue generating bad boy? And if you want, a real life social network to meet real life new friends?

With the slow but steady rise in at home accommodation sites like Airbnb, it has opened up a whole new world of alternative income to many families or singles that might have a spare room that they are willing to rent out. I have been on both ends of the Airbnb coin- as both a host and traveler. And I can definitely say that it’s an incredibly enjoyable experience that can be rewarding on many levels if done right. I’ve met friends from all over the world that have stayed at my places, and had the pleasure of traveling and staying as if I were a local in foreign cities.

Spend a little, get a lot

This post is going to focus on a strategy you can do to your home to make it a killer Airbnb place for any weary traveler to book. If your main goal is to generate income from your home or if you are currently cash strapped then this can be an excellent way to bump up your monthly cash flow and give you and your family a little bit more breathing room. In fact at the end of my example you will see how this couple was able to unlock $100,000 and decrease their monthly mortgage payments to help get their place Airbnb ready!

I want to be an Airbnb host but don’t have the room

This is where you can leverage the power of the equity in your home to help make this income stream a reality.

Note: before starting any project please check with your local municipality to insure you are abiding by all local by-laws.

Here in the City of Toronto the price of real estate has sky rocketed- leaving many of my clients sitting on one of the largest assets in their portfolio, but with very few ways that they can tap into this potential.

These are my top recommendations on how to unlock your equity to help create a passive income stream from your home by hosting Airbnb guests

If you have the space in your home to host a guest (or two) but want to keep your privacy it’s totally understandable. Some hosts prefer to give their guests an uninterrupted stay and there are many guests that would prefer this route as well. With a few simple home renovations many places can be converted into a separate in-law suite.

The easiest way to do this with very little increase in your monthly expenses is to do a refinance on your existing mortgage. This is especially attractive if your mortgage is up for renewal and you are looking to unlock some of the equity that has built up on a home. But, can also be done even if your term isn’t up (many times the math makes sense to still do it)

I’ll give you a simple example to illustrate what I mean:

Mark and Nicole purchased their semi-detached home 5 years ago in a not-so-trendy (at the time) Queen West area known as Trinity Bellwoods. At the time they put 20% down and the purchase price was $350,000. Their mortgage was $280,000 and they were put into a competitive 5 year fixed mortgage @ 2.99%.

Their monthly payments (principal plus interest) is $1,323 per month.

Today their mortgage has been paid down to $239,277

In 5 years Mark and Nicole have married and are planning to grow their family. They need more room, but they also know that when Nicole goes on mat leave their household income will drop. Searching for larger homes in the area is out of the question, as most houses are now in the $700,000 range. Factoring in their current income and possible drop in the future they don’t want to chance stretching themselves too thin.

They have heard about Airbnb from their friends and have considered being hosts but their basement has never been finished.

Since their mortgage is coming up for renewal they call their friendly neighbourhood mortgage broker (aka me!) and we take a look at what a refinance option would look like. This will help them unlock some of their equity to apply on finishing their basement while getting them ready to start generating income from Airbnb or other travel hosting sites.

Unlocking home equity to renovate

These are the numbers under today’s current mortgage rates:

We can refinance Mark and Nicole’s property up to 80% LTV (loan to value). So looking at their current outstanding balance on the mortgage and how the Toronto real estate market has increased over the past five years we have this picture unfolding:

Current market value of home: $725,000

Existing mortgage balance: $239,277

Available equity (@ 80% LTV): $340,723

Woah! That’s a lot of equity they’ve built up! But wait- they don’t need to spend their entire egg, even if it is for renovating their home. They’ve pegged the basement renovations at $100,000 on the top end. So at the current market rate of 2.39% for a 5 year fixed (used as illustrative purposes) under a 30 year amortization their new mortgage of $339,277 will work out to $1,319.17.

Wait. Their monthly payments actually decreased?? Yes, by stretching the amortization an additional 5 years (remember the key right now is maximizing cash flow because they want to grow their family) they can unlock $100,000 for renovations and save themselves $4 per month in expenses.

How much can you make by renting out short term on Airbnb?

Lets assume Mark and Nicole refinanced and renovated their basement. How much realistically can they expect to rent their 1 bedroom basement suite for? Being close to the TTC, parks, and a vibrant Queen West nightlife are all great draws for visitors to Toronto.

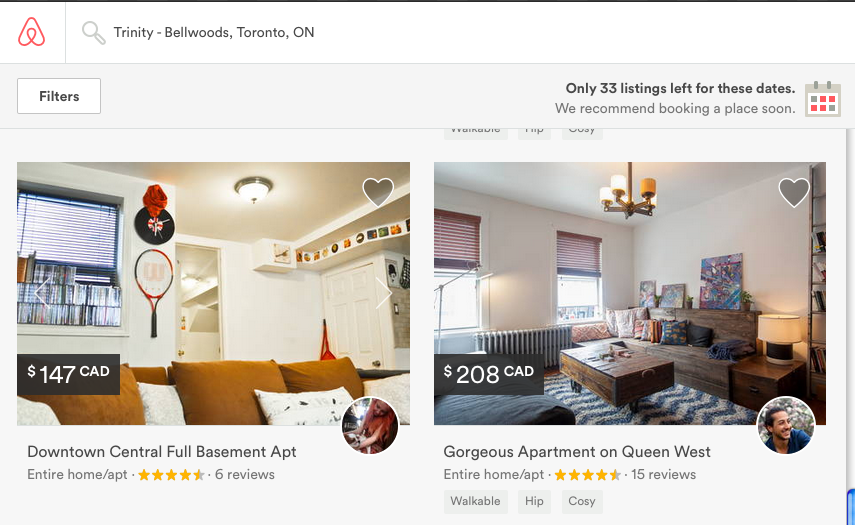

Doing a quick search on Airbnb shows the following Queen West/Trinity-Bellwoods comparables:

If we assume a vacancy rate of 50% per month and a nightly rate of $177 that’s a whopping $2,662.50 per month in extra income- which completely covers their carrying costs of the mortgage two times over! This is a very cash-flow positive strategy.

So as you can see this is a great option for anyone looking to increase their cash flow to compensate for a decrease in income, rise in costs of living, or even to just save up for a rainy day. And the best part is, when their family grows they can stop hosting and start using the basement as additional living space- all without having to move and take on additional monthly stresses or expenses.

Do you live in Toronto and want to host Airbnb guests for extra income?

If you are looking to unlock some of your home equity to start a project like this contact me to help get you into the right mortgage product. Being able to get you a low rate is only one part of the equation and being able to plan out your longer term strategy is something that I love helping my clients with!